There are certain financial challenges that you have to face during your emergencies which can only be controlled through instant funds. And instant cash loans can easily be available when you have a good credit score.

Generally, borrowers have a bad credit score which causes obstacles in the way of getting financial help from the financial institutions. As a matter of fact, a bad credit score is like a curse to the people who need money on the spot.

One of the important things without scrutinization your credit history, loan lenders can’t give you the loan approval. The reason being, they are lending you money so that they can get their money back as well from you on time.

That’s why they check your financial background, after finding you have a bad credit score which makes them skeptical for giving you the instant loan approval. In such situations, you can’t get financial assistance with your bad credit rating.

Not paying your earlier loans on time, makes you a bad credit holder which deprives you of taking all the financial advantages. This makes you feel, how good your credit score is, which may lead to losing a life also. When there is no money for one’s operation.

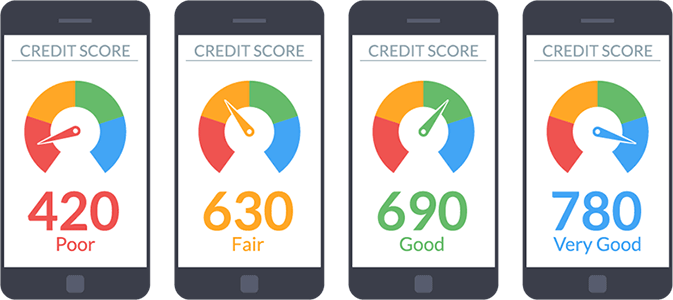

You can only know of bad credit when there is no approval for loans after applying with a bad credit score. And some lenders impose high-interest rates after considering your approval even with the poor credit score.

What is bad credit to you?

It is one of the situations when your credit report reveals that you are surrounded with replete of debts while applying payday loans or other financial help. Irresponsibility towards payments making on time for the loans is responsible for your bad credit.

This bad credit makes you helpless to avail of funds if there is a possibility to get them somehow. Due to bad credit, there are high-interest charges you have to go through while returning the funds back to your online loans lender.

How can I deal with my bad credit?

When you have bad credit, it is good to have some good financial habits and try to remove all the pending debts one by one. Remember, after availing financial help from financial institutions such as loans.

You should continue paying them without skipping paying dates; it can certainly improve your bad credit score to good, which would be beneficial for the future. With your bad credit, there might be some interest charges.

But your financial future will rebuild once again after doing so, this you can feel the next time when you would need any loans.

What are the reasons cause bad credit?

There can be a number of reasons for turning your good credit into bad credit. You actually need to figure them out in silence. Because your bad credit can make you a failure from financial aspects to gain financial profits.

That’s why it becomes indispensable to consider over the reasons which have made you a failure for getting approval of loans with bad credit. You can consider a few of the reasons which play a very crucial role in damaging your good credit.

Have a look at the responsible reasons to bad credit:

- Due to payment missing while repayment

- Paying off with irresponsibility

- Applying for unaffordable loans during emergencies

- Getting approval of many credit cards in less time

- Credit card maxing out is also responsible

How can I improve my credit score back?

Your initial step to improve your credit score can do better by applying some changes; it also depends on how long it is. Still, you can better your credit rating being conscience financially, and by making your payments on time.

Because the credit score is your backbone to deal with finance in both the situations whether you have bad credit score or good credit score. But by saying Ta-ta to your oldest habits of dealing with finance, you can do a great job literally.

You can see how you can do it in a better way so that no financial institution can come afore and say no to you. Once you have raised a request for any loan approval through either your moneylender or any other financial institutions.

You can resort to some tips for your credit improvement:

- Pay off your bills on time

- Never leave your payments for ahead to pay, pay in full

- Avoid opening new accounts frequently

- Get rid of pending debts you have

- Avoid closing such cards you haven’t used yet until you pay any charges

- Have some patience because improvement takes time

- Make a budget and start saving some money

Conclusion

Bad credit is not a problem because it can be with anyone due to hard circumstances. One of the problems is not showing interest to remove it. Borrowers get approval for the loan even with their bad credit, but they repay the loan on time.

This is what financial institutions expect from the borrowers to repay their loan back which is also beneficial for the borrowers ahead.

It’s not about being flawless, it’s about being honest. I write about relationships and life experiences. I also dabble in poetry and fiction…