Your bad credit is responsible for maximum disapproval for any kind of availing financial services because no one wants to bear any loss. Yes, whether there are banks or lenders, you are looking for applying personal loans.

They would like to see how capable you are to pay off their borrowed amount back by checking your credit score. Because your credit rating describes about your financial habits for payment making thus they take this very seriously.

As far as bank loans are concerned, traditional banks get very strict while considering about your concern, when you are a bad credit holder. Due to your bad credit, they sometimes impose high interest rates along with high fee and irritating paperwork formalities.

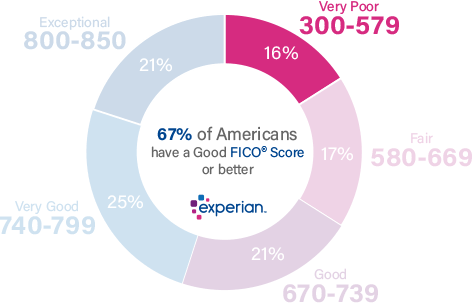

The credit score came into existence in late 1989 which is also known as a FICO score and it has developed a lot so far till today. Earlier the credit was totally dependent on customer’s intention and their behavior with money.

One of the best examples it was possible for you to get an excellent FICO score. But that was totally up to the lenders, they neglected your credit score in case something about you teased them. This was the beginning how it actually went during the year of 1989.

But let’s get back to the main concern of having lower credit. And! know how it affects you negatively while applying the loans from tradition banks. Also you will get the perfect solution as well as suggestion about how to deal with your low FICO score with some other options.

16% of all consumers have FICO® Scores in the Very Poor range (300-579)

What can be challenges with my bad credit to apply bank loans?

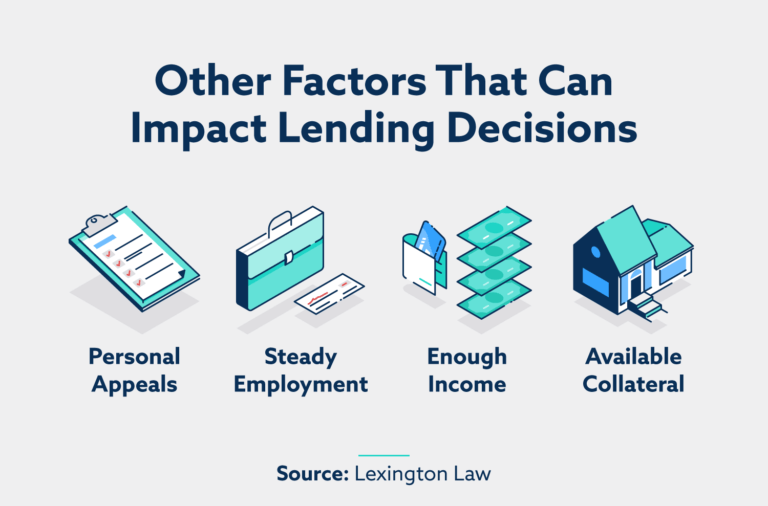

Generally, every financial organization follows their term and conditions. Similarly this is with traditional banks as well to deal with the borrowers with their hard process. No doubt that you would have to face a number of problems while applying bank loans with bad credit.

Apart from that, there might be possibility to make frequent visits to any of the banks in Canada to apply the funds from. So let’s try to know about the challenges that you need to go through with your lower credit score while applying fund help by banks.

- Bad score is one of the major challenges: Traditional banks can create an ordeal for you to go through if you are looking for a loan with low financial condition. You might need to face issues for getting your approval.

- High fee and interest charges than normal: The banks impose high interest rates as well as fee which is also very irritating for you. So you can’t get advantage of lower interest rates and some other facilities with your negative score.

- Proper documentation is must: One single missing document can become one of the main reasons for the disapproval of your request. And! It can’t be possible for everyone who arranged all the required documents at a time. If someone an unemployed applicant then it will be going very tough for them to arrange their income source proof. Also! This situation will be very difficult for those who are living on government benefits like CCTB, ODSP, CERB, Disability-Related Benefits, Emergency Fund and etc.

- No fund availability on time: Fortunately! If everything done smoothly with the bank still you can’t get the funds at the time, you need most. You might also need to make frequent visits to the bank for the confirmation and that is not possible for disable people.

- Contact during business hours only: This is the very big issues that you can contact to the bank for loan only whenever they are opened i.e. Monday to Friday between 9 to 5 working hours. It means you can’t apply the emergency funds whenever there are extreme financial exigencies.

What option for applying loan with bad credit in Canada?

There is another option for you which is hassle free of everything. You might not believe at first that’s why you will get a proper guidance about it. With bad credit, anyone can consider emergency payday loans no matter what score. This is actually a short-term cash advance over any income source (government benefits or regular salary) to solve inescapable requirement.

This kind of funds can actually help you fix your current problems. Whether you have negative or positive FICO rating, you can still get the guaranteed fast approval than the traditional banks in Canada. There is no hard requirement to apply.

How can I apply for payday loan online?

The process is so simple for every Canadian who is looking for the emergency loans with bad credit. Even for those they have no job for income proof. They can directly visit PaydayBunnyTM rather than somewhere else. And you need to fill out 3 step application form with your less time consumption with putting some basic information.

You get a notification as well congratulating that your loan is approved. Once you are done with that, you need to pick up the amount which is from $100 to $5000.

And you need to submit over there by hitting the submit button after choosing the amount. You can get the e-TransferTM loan direct to your bank account after 15 to 20 minutes process.

Conclusion – For Money Loan Requirements

It is acceptable that your poor score keeps on creating hurdles. Because whenever you need any sort of financial assistance like personal loans, car loans, home loans and etc. You should find the cause which lowered your credit score and simultaneously you need to start working on that.

You should adopt good financial habits to build your credit score. As far as applying a loan is concerned with bad credit then there are payday loans guaranteed available for you every time, with fast approval.

Hi, I’m Selena My home is in Toronto but my heart is in the mountains. I share advice, info, inspiration, and in my spare time enjoy working on DIY remodeling projects.